Bitcoin As A State Transition System

From a technical standpoint, the ledger of a cryptocurrency such as Bitcoin can be thought of as a state transition system, where there is a “state” consisting of the ownership status of all existing bitcoins and a “state transition function” that takes a state and a transaction and outputs a new state which is the result. In a standard banking system, for example, the state is a balance sheet, a transaction is a request to move $X from A to B, and the state transition function reduces the value of A’s account by $X and increases the value of B’s account by $X. If A’s account has less than $X in the first place, the state transition function returns an error. Hence, one can formally define:

APPLY(S,TX) -> S' or ERROR

In the banking system defined above:

APPLY({ Alice: $50, Bob: $50 },"send $20 from Alice to Bob") = { Alice: $30, Bob: $70 }

But:

APPLY({ Alice: $50, Bob: $50 },"send $70 from Alice to Bob") = ERROR

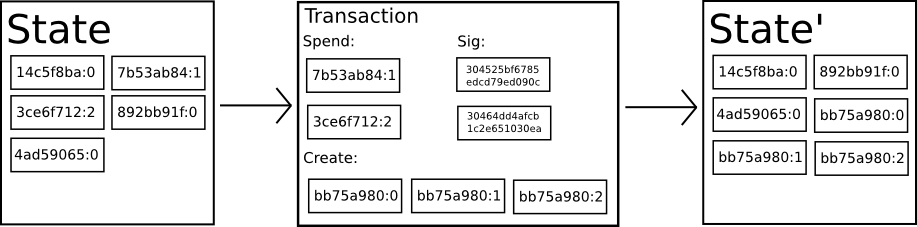

The “state” in Bitcoin is the collection of all coins (technically, “unspent transaction outputs” or UTXO) that have been mined and not yet spent, with each UTXO having a denomination and an owner (defined by a 20-byte address which is essentially a cryptographic public key[Note 1]). A transaction contains one or more inputs, with each input containing a reference to an existing UTXO and a cryptographic signature produced by the private key associated with the owner’s address, and one or more outputs, with each output containing a new UTXO for addition to the state.

The state transition function APPLY(S,TX) -> S' can be defined roughly as follows:

- For each input in

TX:- If the referenced UTXO is not in

S, return an error. - If the provided signature does not match the owner of the UTXO, return an error.

- If the referenced UTXO is not in

- If the sum of the denominations of all input UTXO is less than the sum of the denominations of all output UTXO, return an error.

- Return

S'with all input UTXO removed and all output UTXO added.

The first half of the first step prevents transaction senders from spending coins that do not exist, the second half of the first step prevents transaction senders from spending other people’s coins, and the second step enforces conservation of value. In order to use this for payment, the protocol is as follows. Suppose Alice wants to send 11.7 BTC to Bob. First, Alice will look for a set of available UTXO that she owns that totals up to at least 11.7 BTC. Realistically, Alice will not be able to get exactly 11.7 BTC; say that the smallest she can get is 6+4+2=12. She then creates a transaction with those three inputs and two outputs. The first output will be 11.7 BTC with Bob’s address as its owner, and the second output will be the remaining 0.3 BTC “change”. If Alice does not claim this change by sending it to an address owned by herself, the miner will be able to claim it.